Prime Minister Joseph Muscat emphasised that the new Government will be approaching the financial services sector with continuity that safeguards stability while exploring ways to branch out into new markets.

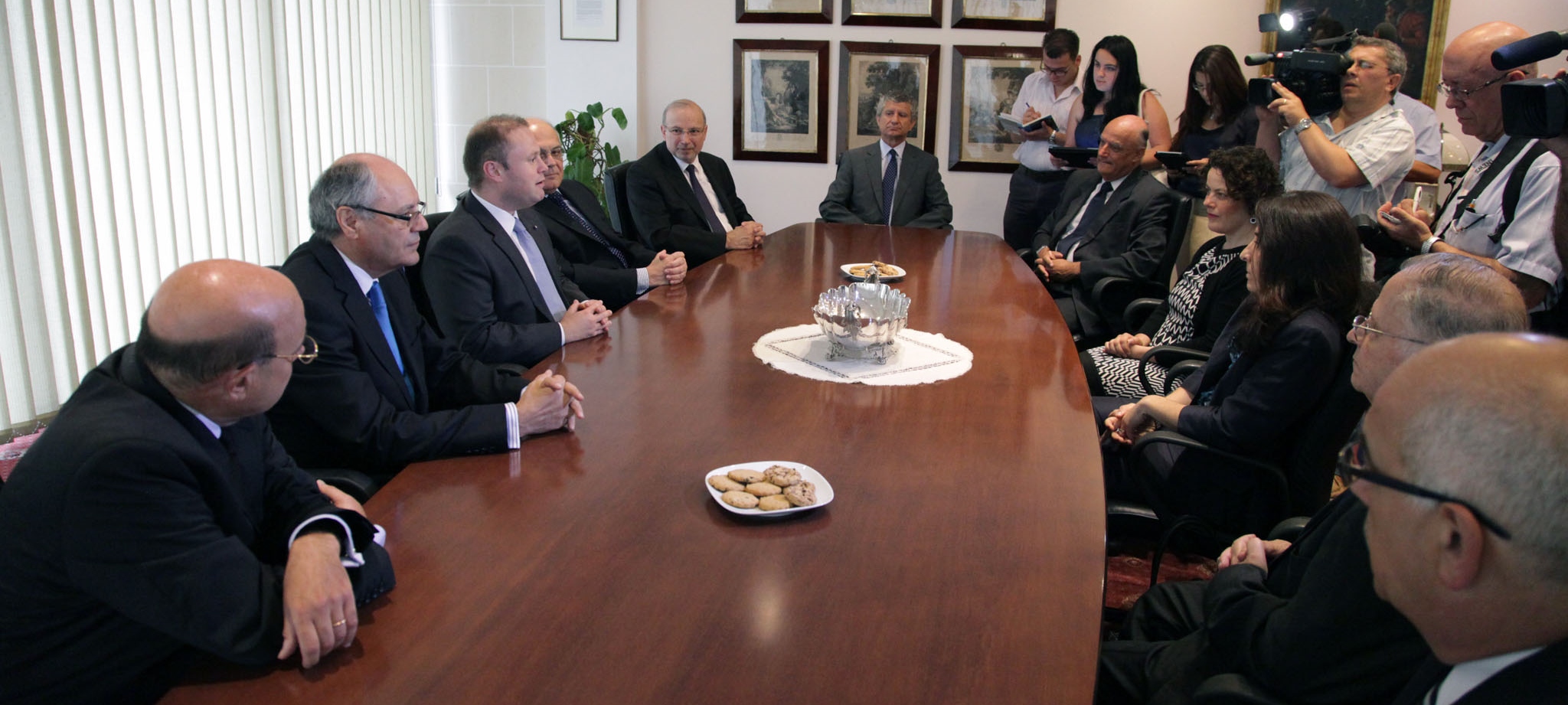

Dr. Muscat was speaking during a visit at the Malta Financial Services Authority (MFSA) with Finance Minister Prof. Edward Scicluna, during which they both met with the MFSA Board and Staff members.

Accompanied by MFSA Chairman Prof. Joe Bannister, Dr. Muscat and Prof. Scicluna held a brief meeting with the MFSA board, and subsequently addressed assembled MFSA staff members.

During his address, Prime Minister Joseph Muscat emphasised that the new Government is looking towards the financial services sector as a growth sector, and said that the Government’s approach to the sector and the MFSA would be one of continuity in the interest of safeguarding stability and investment.

“This is a mature European democracy that, in the midst of a financial storm, stands as an oasis of stability,” Dr. Muscat said, noting that one of the reasons behind the success of the financial services sector is the bipartisan parliamentary approval that the legal framework governing the sector enjoyed.

“Every law that passed through parliament related to the financial services sector did so unanimous support and approval. I augur that this unanimous support will allow the financial services sector to keep growing.”

Dr. Muscat noted that the prospects for the financial services sector are positive; pointing out that Government is proactively exploring new and innovative ideas regarding which new markets can be explored. “We must remain optimistic and positive. We must remain open to criticism that is being levelled at us, while at the same time we must keep firmly underlining that Malta is a reputable jurisdiction,” Dr. Muscat said.

The Prime Minister emphasised that Malta did well to retain its standards, noting that while other jurisdictions were being overwhelmed by crises over the past few months, it would have been all too easy to open for Malta to open its doors.

“This is a country where operators must be reputable. We have our standards, and we should not lower or undermine them to accommodate operators, but it is operators that must raise their standards to meet ours,” Dr. Muscat stressed.

“With four months’ worth of hindsight, already we are seeing the result of that firmness. Even when speaking on a political level with other EU Financial Ministers, we use this example to show that our country is different. We retained our standards, and it is paying off already.”

Dr. Muscat also said that the one of the Government’s targets for the financial services sector is, with collaboration with MFSA, to ensure more consumer protection, especially with regards to those products and services that are sold in Malta.

He said that at a time when consumers are more education, aware, and networked, more investment and collaboration between Government and regulatory entities is required to not only ensure that consumers are protected, but also potential issues are identified and anticipated ahead of time.

During his own address, Finance Minister Prof. Edward Scicluna said that the MFSA should be proud of its crucial role as a micro-prudential supervisory entity, noting that despite EU-wide preparations, a financial crisis still took the Eurozone by surprise.

He noted that the political fallout, both on national and European levels, created a reaction for more regulation. “Tax payers do not want to pay for the mistakes made by financial institutions, which, in an irresponsible manner, brought on this crisis themselves.”

Prof. Scicluna noted that this has led to a situation where politicians and legislators are being called upon to enact more stringent laws governing and regulating financial institutions than before. “As a result, every risky aspect of financial activity is being regulated.” Prof. Scicluna stressed that this is important because it is intrinsically linked to the financial stability of the country.

“Financial stability is something intangible and very often is not a leading concern among the population, if lost it can nevertheless lead to considerable financial and economic hardship which can afflict a country for many years.”

Prof. Scicluna also announced that the Government intends to, following consultation with the Central Bank and the MFSA, enter into a Memorandum of Understanding which will allow the three entities to jointly monitor the country’s financial stability, and co-coordinate their activities while ensuring that each entity respects its mandate.

“Any shift that could risk affecting or undermining Malta’s financial and economic stability will be scrutinised closely, and any action that is required will take place in a decisive and timely manner.”

Prof. Scicluna also welcomed the opportunity to meet with the MFSA board members and staff, noting that, as someone in the past was involved in the management of the institution, he was pleased to recognised some familiar faces. He added that he is looking forward to a time when he would be able to meet with MFSA staff on an individual basis.

Both Dr. Muscat and Prof. Scicluna emphasised that the MFSA the has an important role to play in the future development of the financial services sector, and needs to keep adapting to remain current and be able to cooperate closely and work hand-in-hand with financial services operators.

[nggallery id=145]

– Friday, 5th July, 2013