“A fortnight ago, less than a week after the publication by the OECD of its Interim Report on the implications of digitalisation for taxation, the European Commission issued several proposals on a Fair and Effective Tax System in the EU for the Digital Single Market, including a directive proposal on a Digital Services Tax, a directive proposal on the introduction of a digital permanent establishment concept, and recommendations to member states to implement this concept in their double tax treaties.

In view of these developments, we need to carefully assess the situation and move with caution, particularly on how far one can go when ring-fencing the digital economy for tax purposes. We also need to ask ourselves whether it is wise that the EU should move forward without its international partners on the taxation of the digital economy”.

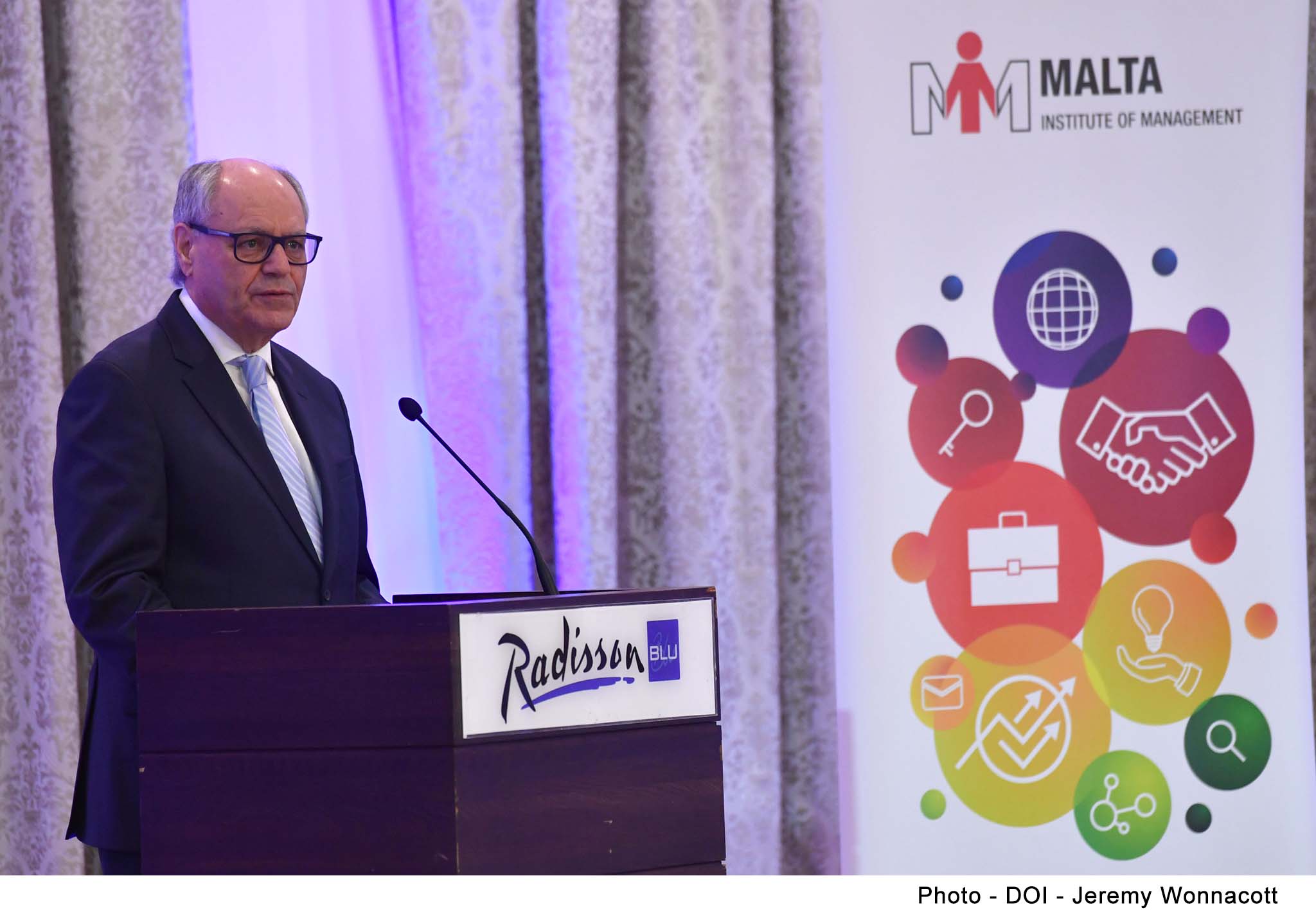

This was stated this morning by Finance Minister Edward Scicluna while addressing the 12th Malta Institute of Management (MIM) International Tax Conference on Digital Taxation, at the Radisson Blu Resort, St Julian’s.

Minister Scicluna stated that the digital economy must not be viewed as just technological innovation, but rather as an enabler of the broader economy and society. He also remarked that Malta is aware of the recent developments and is working hard with a view to lead in this area of business.

Finance Minister Edward Scicluna concluded by mentioning that countries should work together towards finding an international solution rather than opting for a quick fix.

A number of local and foreign tax experts including Krister Andersson (Member of the EESC), Prof Pasquale Pistone (Professor at Wirtschaftsuniversitat in Vienna), Helen Pahapill (adviser at the Ministry for Finance of Estonia), Emiel Reijerse (the Netherlands), and Dr Alessandro Turina (University of Lausanne), also spoke during the conference.

Friday 6th April 2018